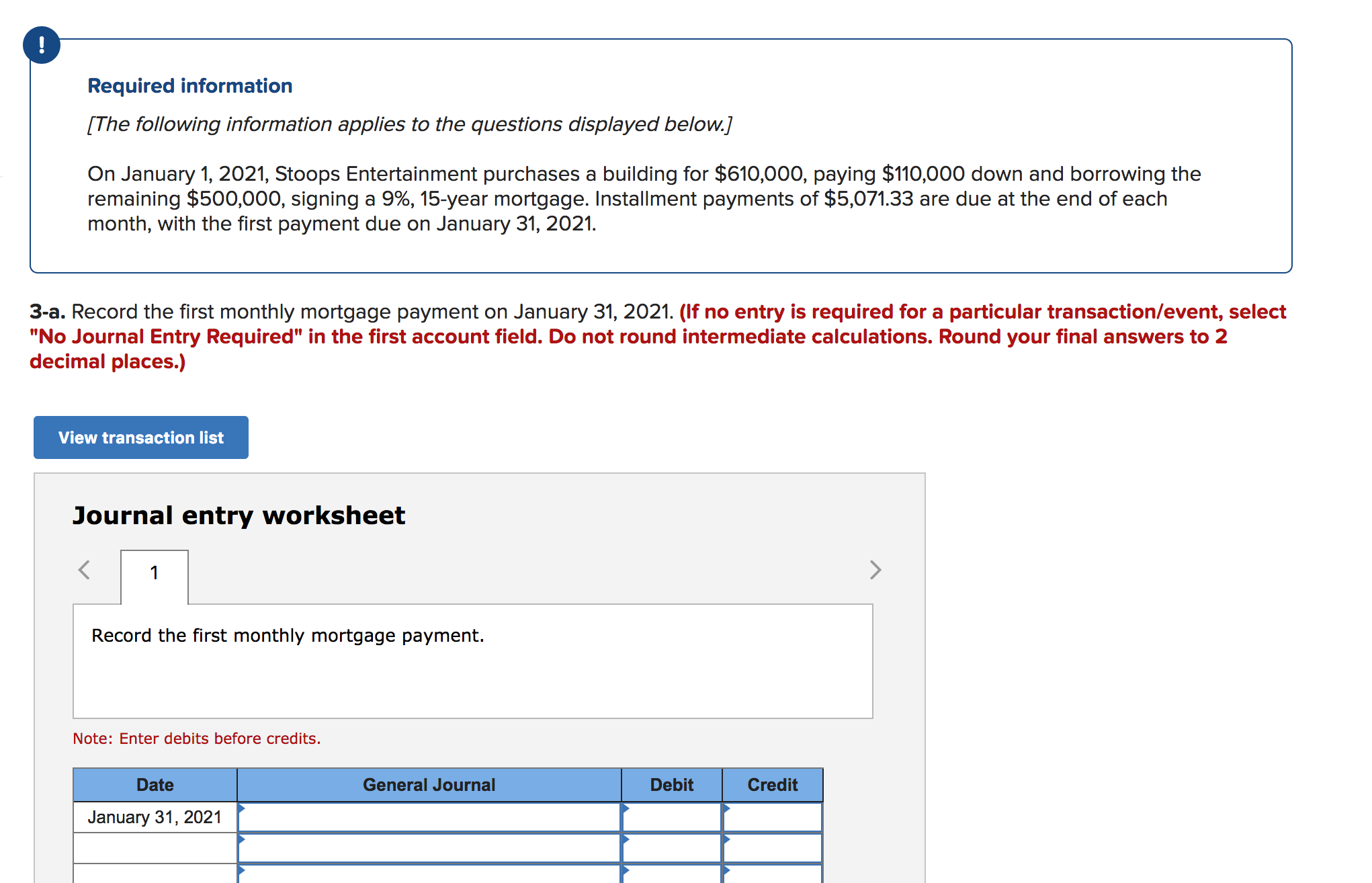

IRS Tax Return 2021 Where is Your Tax Refund 2021? How to Track Your

Key Takeaways Line 10100 is the space on your Canadian tax returns where you enter all of the employment income earned in the year. You must report your total income sources including your wage, salary, tips, commissions, bonuses, gratuities, and honoraria.

HMRC 2021 Paper Tax Return Form

If you report employment income on line 10100, you can claim the Canada employment amount on line 31260 of your return. If you do not receive your T4 slip by early April or if you have questions about an amount on a slip, contact your employer. If you are a resident of Quebec, report all amounts from your federal slips (T4) on your federal return.

8+ a fully amortizing mortgage loan is made for 80000 MiteshKimmy

Line 10100 is located in the "Income" section of your tax return, specifically under the "Total Income" heading. It's here where you'll report the income you've earned from employment over the tax year.

What is Line 10100 on tax return? — Tax Heroes

Line 10100 of your tax return is on the second page of the T1 General form, in Step 2. It is typically the first box listed on any province or territories' return in the section called "total income." If you are using TurboTax Online, you can see Line 10100 by viewing the Detailed Tax Summary in the Review section. Why is Line 10100 Important?

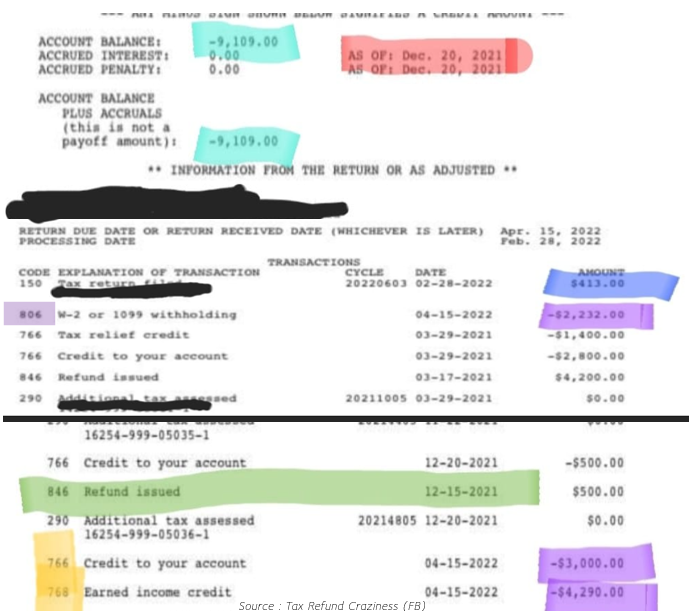

What is Line 10100 on Tax Return (formerly 101) Notice of Assessment

The tax line 10100 is where a Canadian resident would declare their employment income. This amount will include: For the upcoming tax season, your employer/ employers will provide you a T4 slip. In this slip, there is a "box 14" that reports all your employment income. The total amount shown in this "box 14" in the T4 slip is shown in line 10100.

What Your IRS Transcript Can Tell You About Your 2022 IRS Tax Return

Table of Contents show What is Line 10100 On Tax Return? Line 10100 is the line that captures the employment income on your Canadian tax returns. Employment income are usually shown in box 14 of the T4 tax slips you received from your employer (s).

What is Line 15000 Tax Return (formerly Line 150) in Canada?

In conclusion, Line 10100 on your tax return represents your total income, which is the starting point for calculating your tax liability and eligibility for various tax credits and benefits. It's crucial to report your income accurately to avoid issues with the CRA and to ensure you're taking advantage of all available tax benefits. By.

How do I find a line number from my tax return? Help Centre

COVID Tax Tip 2022-16, January 31, 2022. IRS Free File, available only through IRS.gov, is now accepting 2021 tax returns. IRS Free File is available to any person or family with adjusted gross income of $73,000 or less in 2021. The fastest way to get a refund is by filing and accurate return electronically and selecting direct deposit.

What Is Line 10100 on Your Tax Return?

Line 10100 is one of the most important lines on your tax return. It's where you enter all the employment income earned for the year. If you are filing a simple tax return and your total income was on one t4, then you just enter that amount. If your return is a little more complex and you have more than one source of income, you would need to.

What is line 10100 and 10400 on tax return? YouTube

2021 US Tax Calculation for 2022 Tax Return: $10.1k Salary Example If you were looking for the $10.1k Salary After Tax Example for your 2021 Tax Return. it's here Brace yourselves for a surprise!

StudioTax Canadian Personal Tax Software tax software

Where Can You Find Line 10100 On Your Tax Return? If you look at a completed federal tax return from the year 2019 or later, Line 10100 should be the first line located under "Step 2 - Total Income", which is normally on Page 3 of your T1 - Income Tax and Benefit Return (also called a T1 General Form).

What Is Line 10100 On Tax Return? Tax Help RightFit Advisors

Line 10100 - Employment Income: From Box 14 on your T4 - Statement of Remuneration slips. Line 10400 - Employment Income Not Reported on a T4 Slip: Such as tips and gratuities, or casual income not reported on a T4.

What is Line 10100 Tax Return (Formerly Line 101) in Canada?

Elections Canada Foreign property Step 2 - Total income Amounts that are not reported or taxed Report foreign income and other foreign amounts Line 10100 - Employment income Line 10400 - Other employment income Line 11300 - Old age security (OAS) pension Line 11400 - CPP or QPP benefits Line 11500 - Other pensions and superannuation

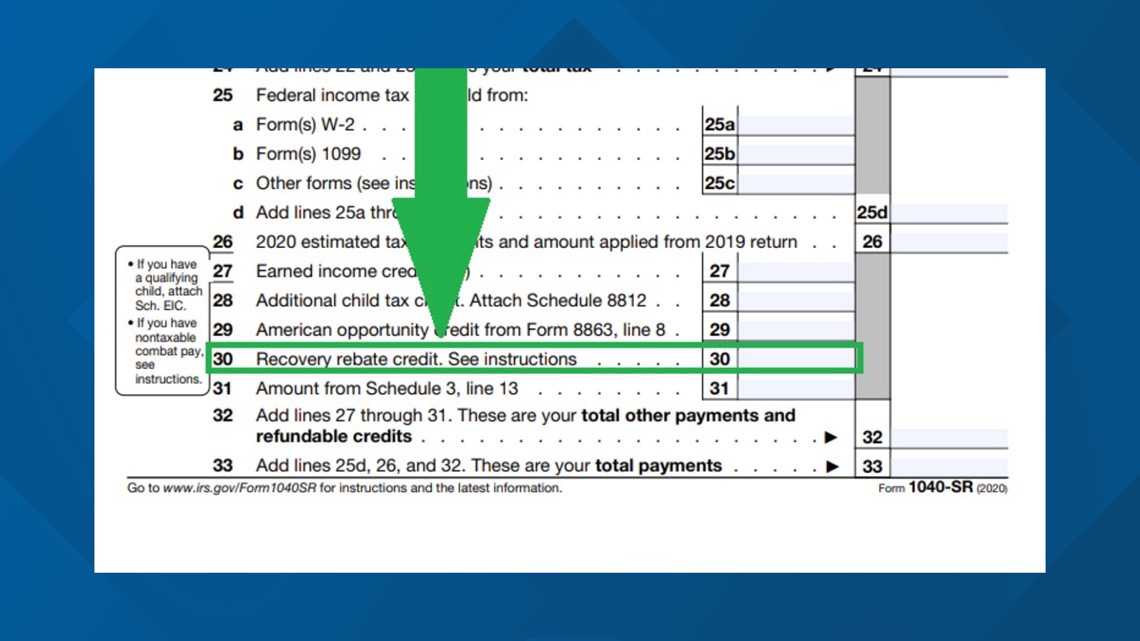

How to claim the stimulus money on your tax return

Line 10100 on your Income Tax and Benefit Return form represents your employment income. If you had to submit a tax return before the tax year 2019, this would have been known as line 101.

What is Line 10100 on Tax Return (formerly 101) Notice of Assessment

Direct Deposit. Reduced Refunds. Fix/Correct a Return. You can check the status of your 2023 income tax refund 24 hours after e-filing. Please allow 3 or 4 days after e-filing your 2021 and 2022 tax year returns. If you mailed a return, please allow 4 weeks before checking your status.

What is Line 10100 on Tax Return (formerly 101) Notice of Assessment

Line 10100 is the sum of all the amounts recorded in box 14 of your T4 slips, representing your job income. Employment income is reported on form 10100, although it may not be the whole of your take-home pay. You may locate this sum on your tax return down below line 15000.